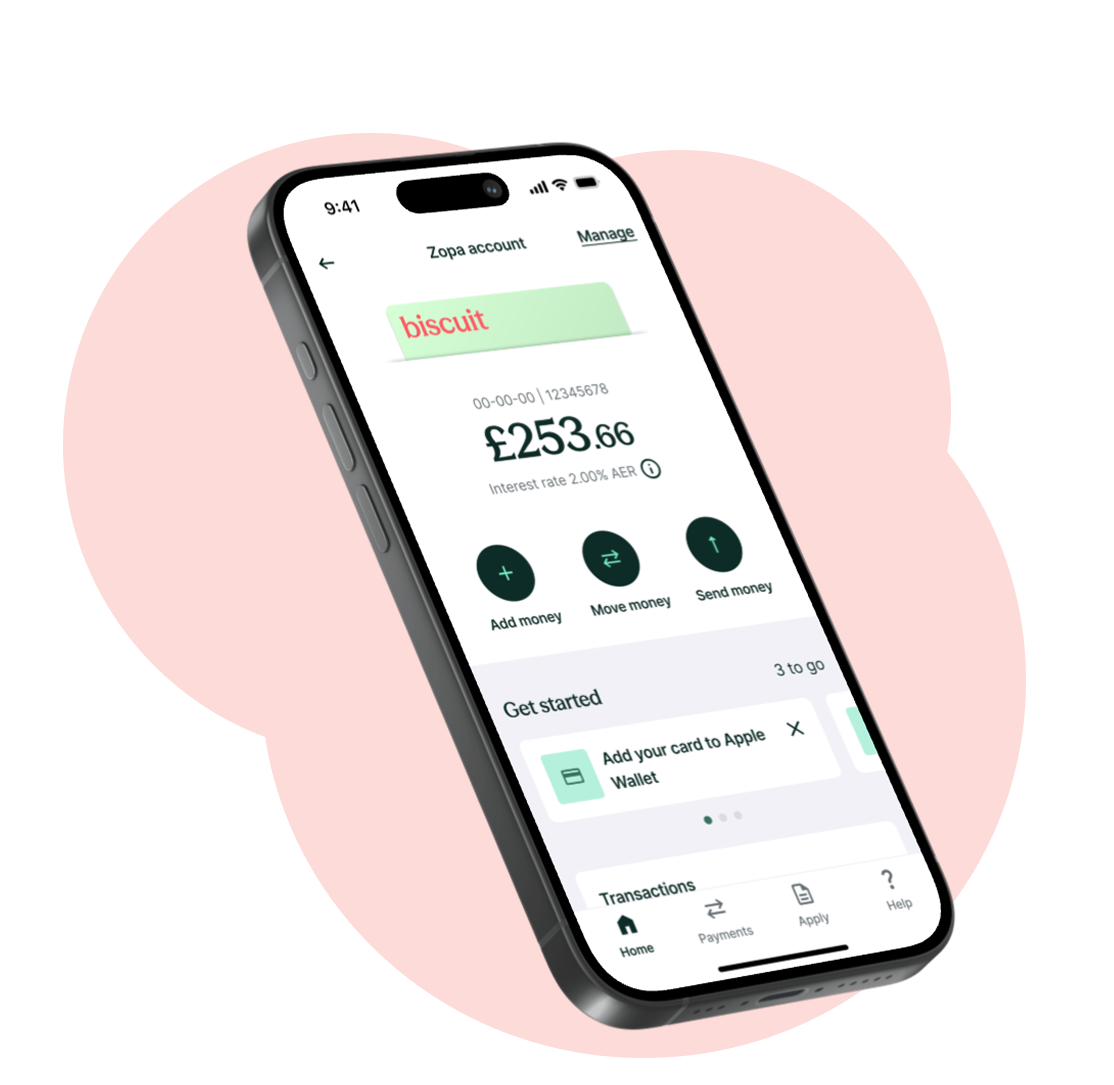

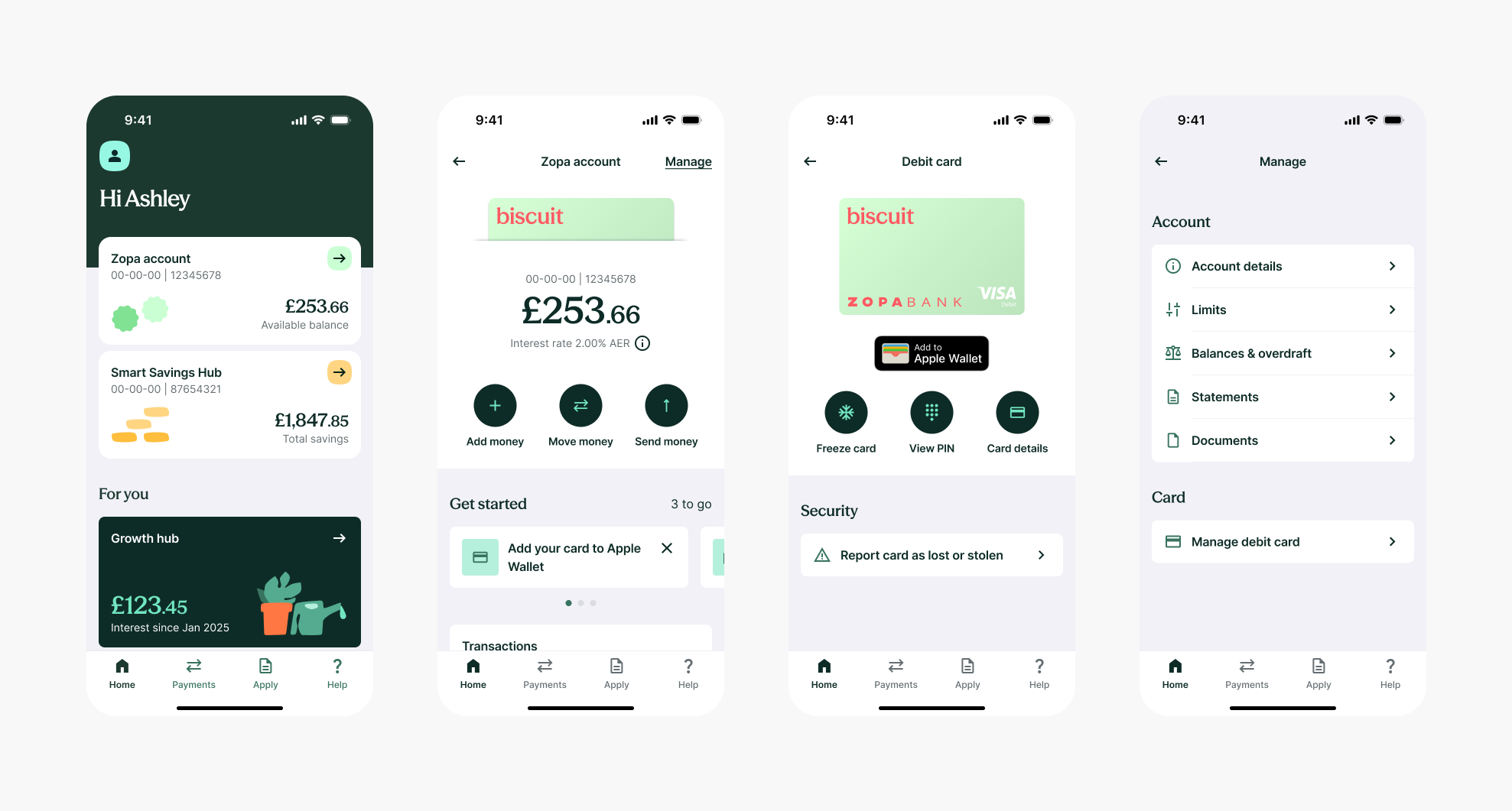

I was very proud to be part of this major product launch that took over 24 months for the company to build (I was involved for 18 months). A current account is a large and complicated product, so it was challenging to build a highly rewarding, easy to use and delightful experience capable of attracting customers away from their existing accounts.

The project’s success hinged on maintaining a fast delivery pace. It required me to be highly organised and stay closely aligned with the roadmap. Every week was planned and optimised working closely with my PM and Engineering Manager. It sharpened by presenting skills by regularly presenting to senior PMs and Directors.

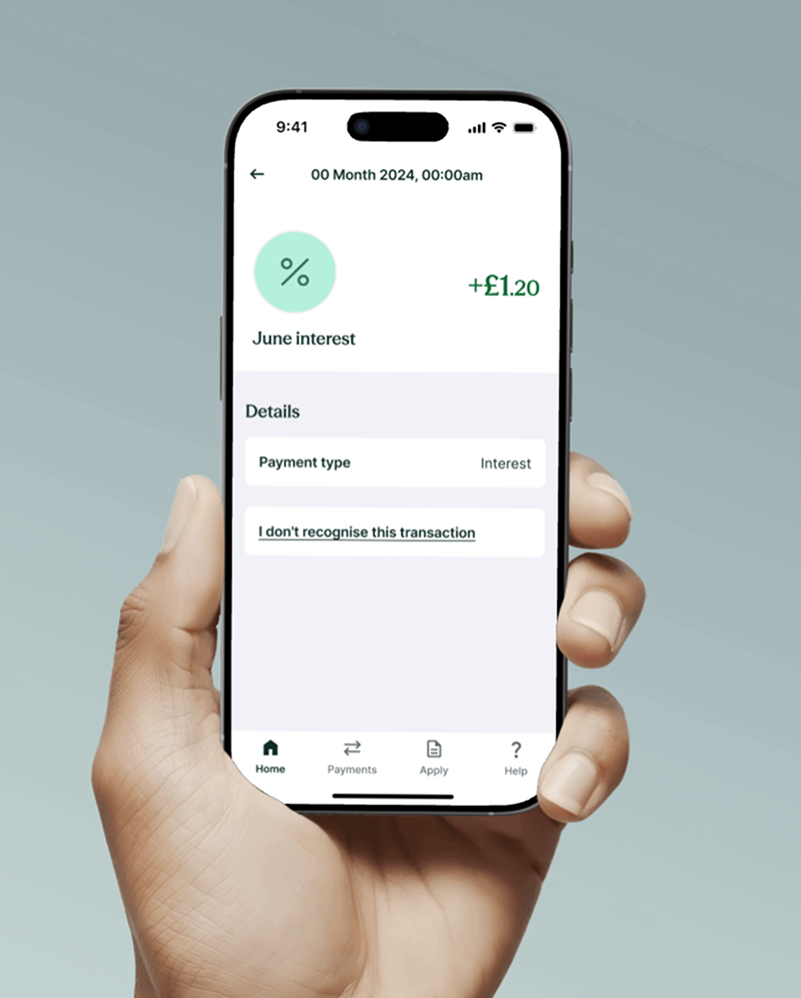

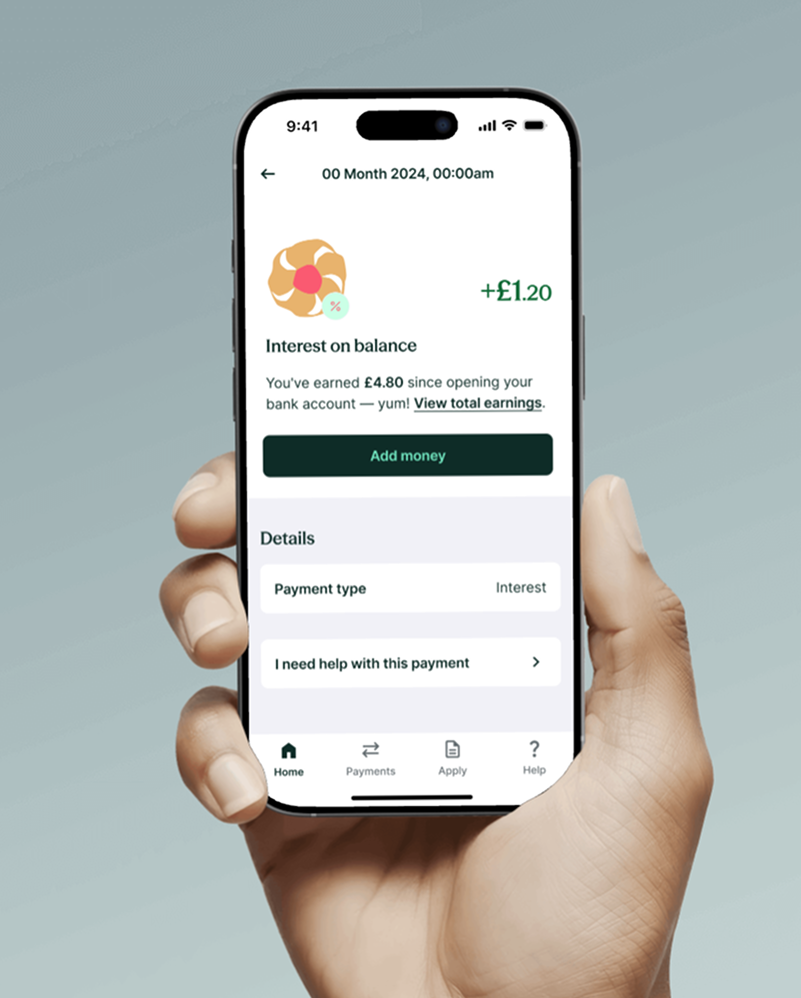

Now that we have usage data and a regular line of feedback from customers, we have an opportunity to make improvements and measure the impact. I will add this to my portfolio in due course.