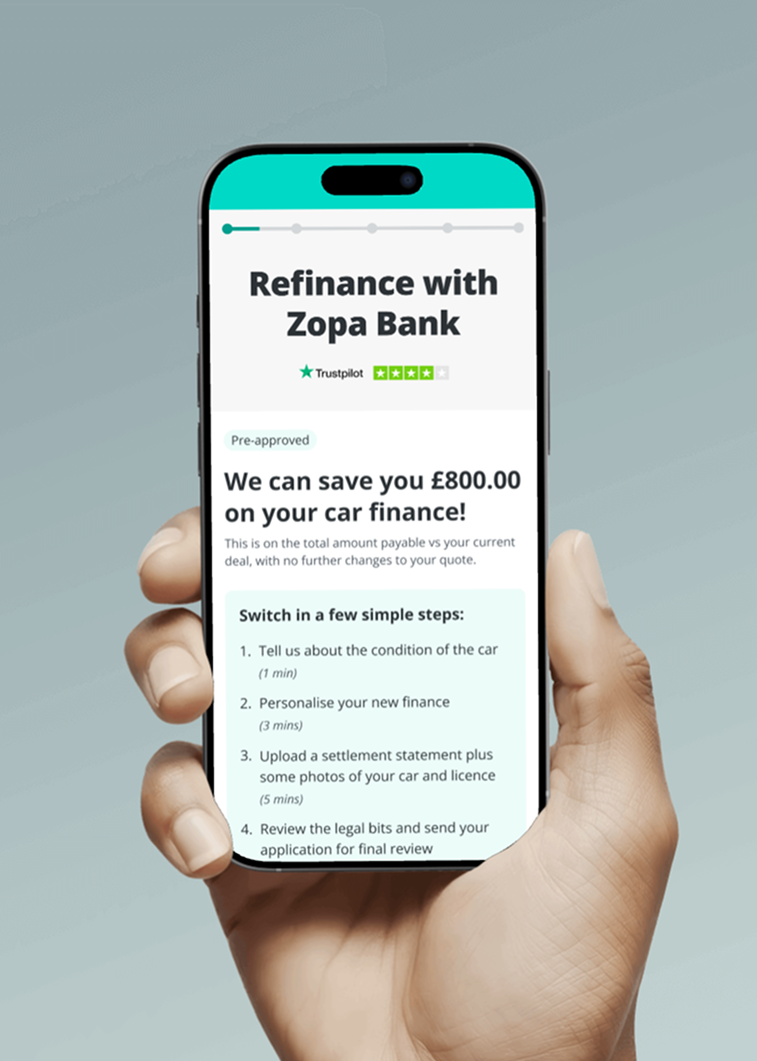

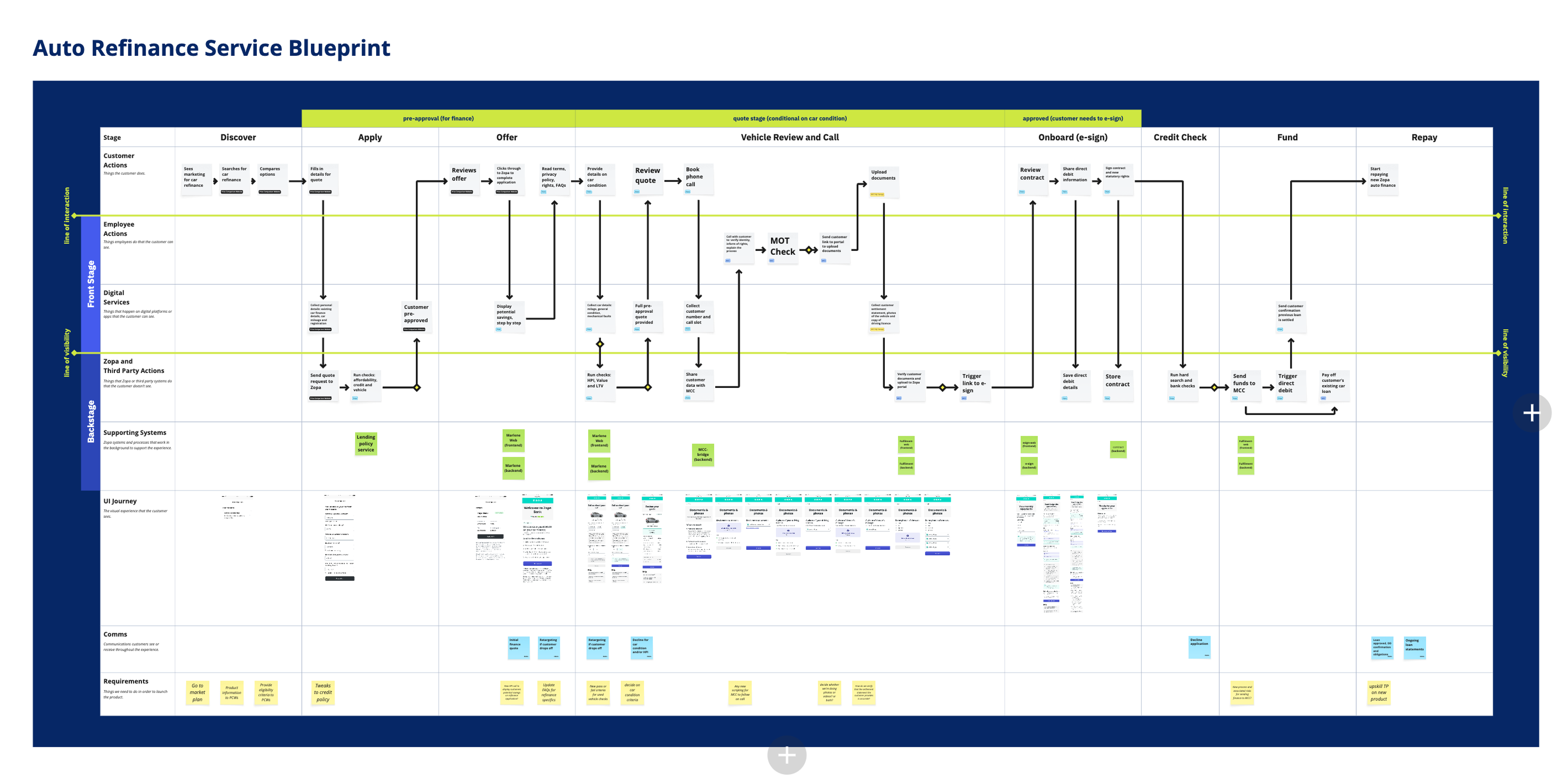

This was a successful sprint in that we collectively produced a well-informed service blueprint, including a refined UX/UI customer journey all within the allotted time.

The project was put on hold whilst the car finance squad reassessed their strategy, but has been picked back up in 2025.

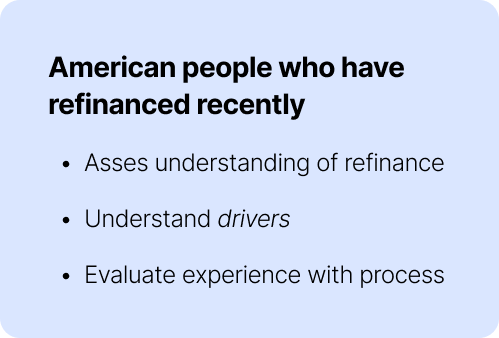

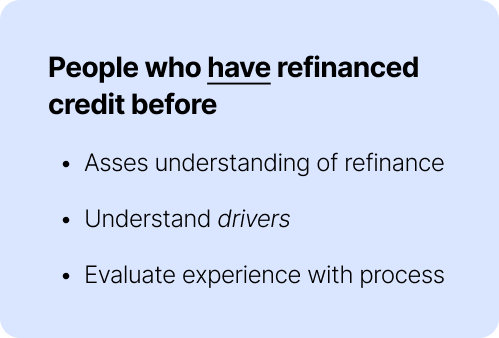

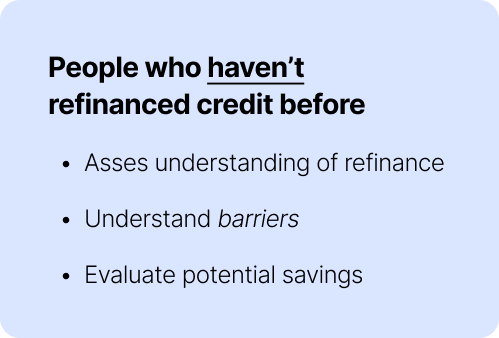

Research is key when entering a new market

- Be very clear on what you need to learn and structure accordingly.

- Dig deep on mental barriers to understand the “why’s”.

- Be prepared the look far and wide (US market).

Service blueprinting is valuable

- It’s enforces a structured approach, which keeps you organised and thorough.

- It’s a great tool for stakeholder management.