This project went live in July 2025 and has delivered a positive impact on reducing Operational effort and costs. Customers are navigating the experience with ease, leading to cases being created and resolved significantly quicker than before.

Reflecting on the project, this was a real test of stakeholder management. It was rare to have so many stakeholders and I initially underestimated how many would be involved. However, I was pleased with how I adapted, got organised and engaged appropriately. It was a valuable reminder of being clear on stakeholders as early as possible.

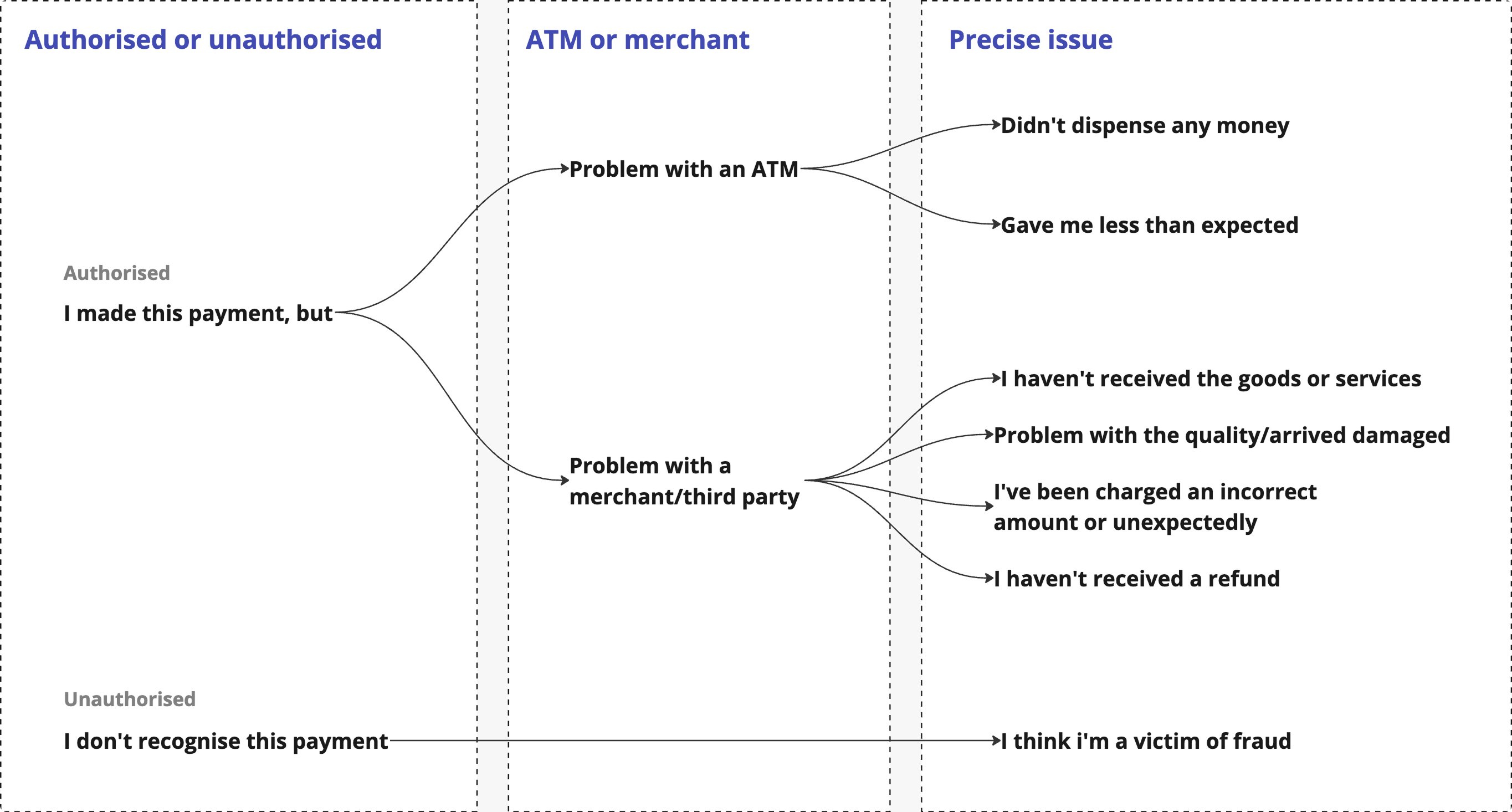

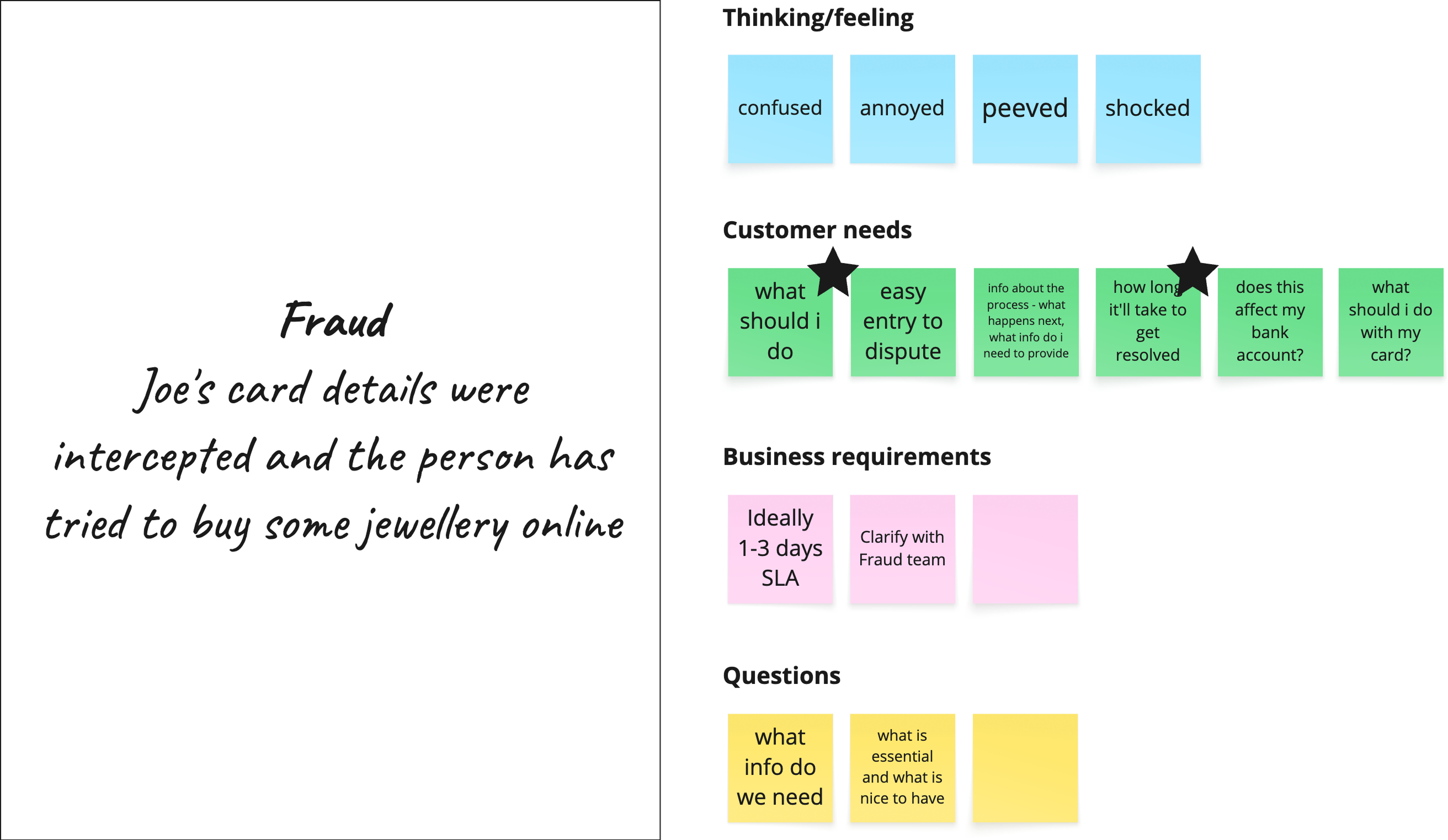

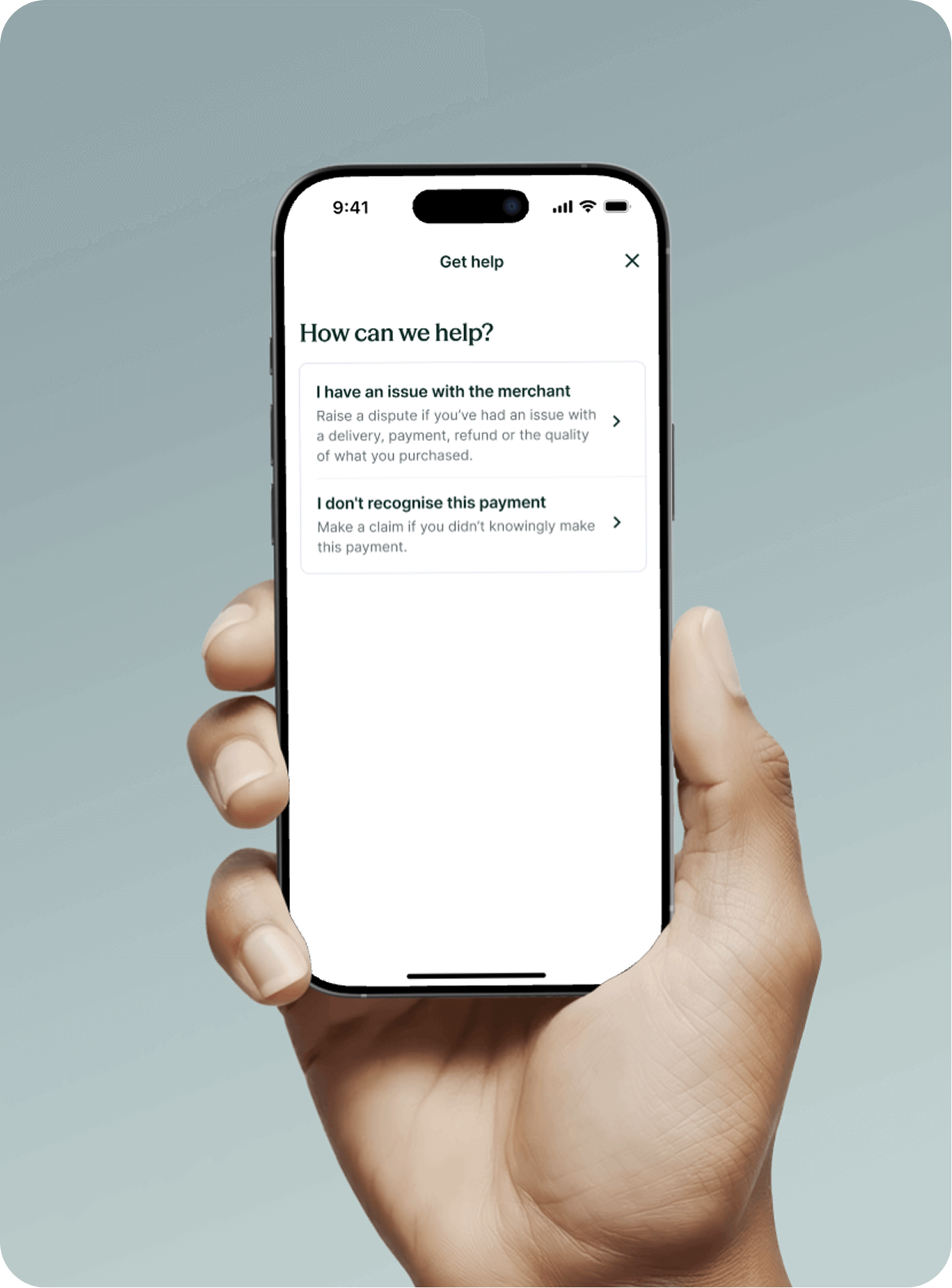

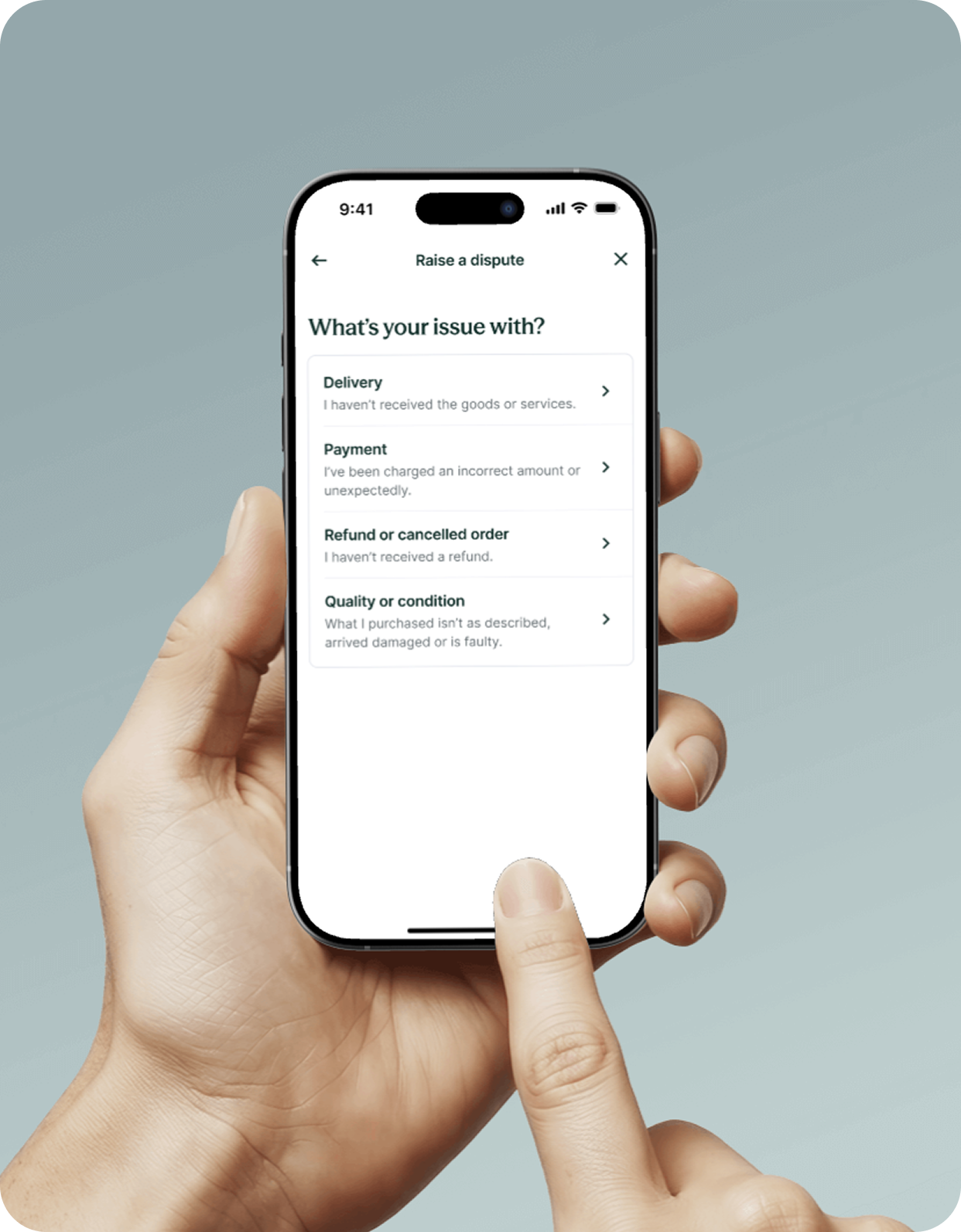

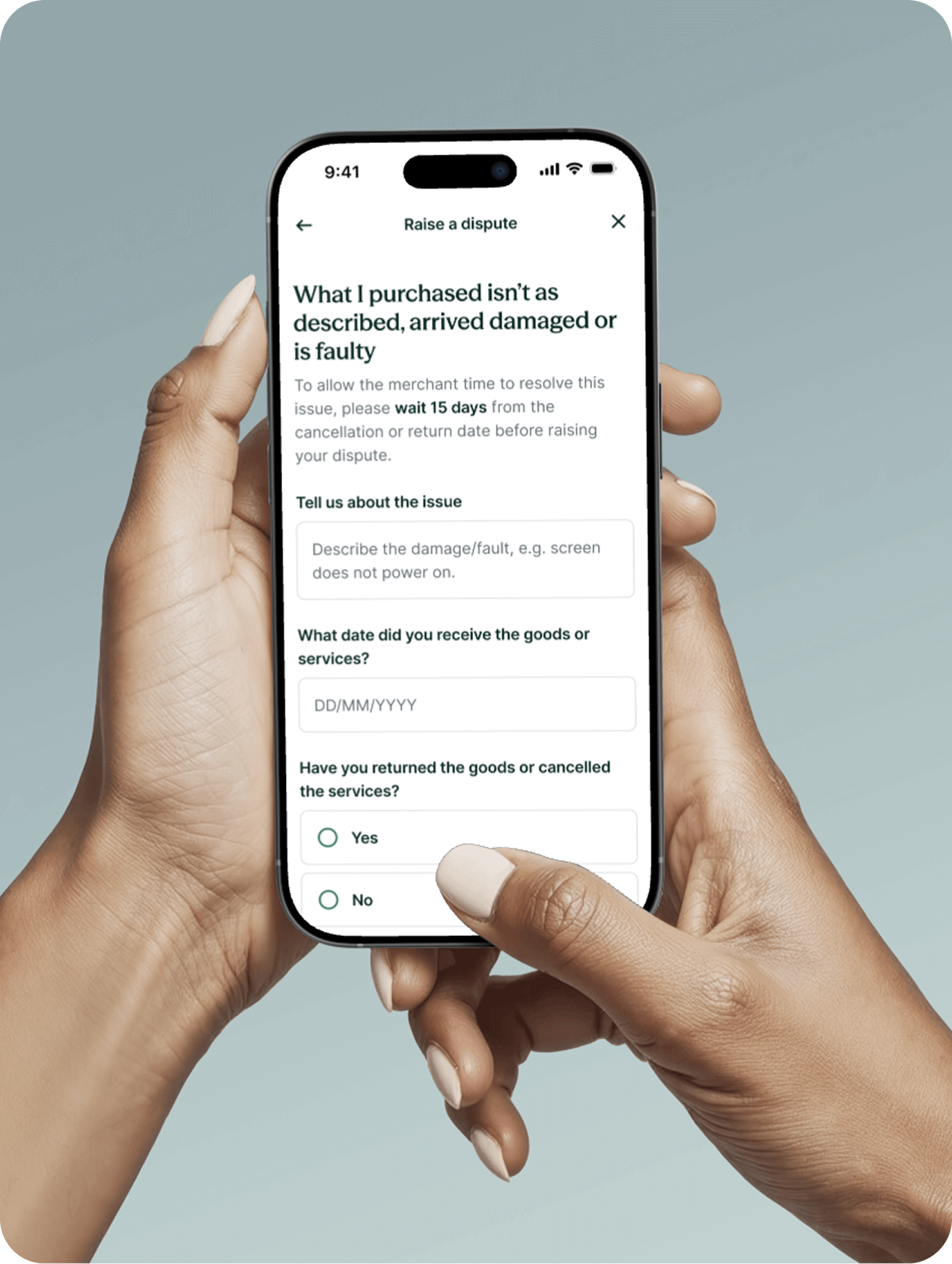

In terms of the journey, I feel confident that I’ve met business objectives and customer needs in equal measure. The journey is simplified as much as possible, easy to navigate and informative to help mitigate sensitive customer needs.